Asia FIU is dedicated to safeguarding the financial ecosystem across Asia. We provide expert intelligence, in-depth analysis, and actionable insights to detect and prevent financial crimes, ensuring integrity, compliance, and trust in banking and corporate sectors.

Our specialized teams leverage advanced analytical tools and proprietary methodologies to identify fraudulent transactions and suspicious patterns. We help financial institutions and corporate clients maintain regulatory compliance while mitigating risk and protecting their assets.

Our investigative services combine intelligence gathering, forensic analysis, and due diligence to uncover hidden risks and illicit activities. We support banks, fintech companies, and governmental organizations with timely, accurate insights for informed decision-making and proactive risk management.

Asia FIU provides comprehensive advisory services to help organizations navigate complex financial regulations. From AML policies to internal audits and compliance frameworks, we ensure our clients meet evolving legal standards while strengthening operational resilience.

our benefit feature

Why choose us

Deep Financial Intelligence Expertise

Our analysts and investigators bring years of experience in fraud detection, AML compliance, and financial crime prevention across Asia’s banking sector.

Discreet & Confidential Operations

Every investigation is carried out with strict confidentiality protocols, ensuring client privacy and data protection.

Advanced Investigative Technology

We utilize modern data analytics, AI-driven tools, and global database access to uncover suspicious activities and hidden risks.

Fast, Accurate & Actionable Insights

From identifying threats to delivering clear intelligence reports, we provide timely insights that support informed decision-making.

About Asia FIU

Protecting the Integrity of Asia’s Financial System

Asia FIU is a Hong Kong–based financial intelligence agency focused on protecting the integrity of the Asian financial system. We specialize in fraud investigation, AML compliance, risk intelligence, and due diligence services for banks, fintech companies, and corporate institutions.

Our team combines regional expertise, advanced investigative technologies, and deep analytical skills to identify suspicious activities, uncover financial threats, and support clients with actionable insights. With a commitment to accuracy, confidentiality, and regulatory alignment, we help organizations stay compliant and secure in a rapidly evolving financial landscape.

Focus Areas

Our Core Focus Areas

Financial Crime Prevention

We detect, analyze, and prevent fraudulent activities across banking and corporate systems to protect financial integrity.

AML & Regulatory Compliance

We help institutions meet Anti-Money Laundering and regulatory standards through expert guidance, audits, and compliance frameworks.

Investigative Intelligence

Our team conducts advanced investigations using data analysis, cross-border intelligence, and forensic techniques to uncover hidden risks.

Due Diligence & Risk Management

We provide deep background checks, risk assessments, and intelligence reports to support safe and informed decision-making.

Strengthening Financial Security Across Asia

Asia FIU delivers trusted intelligence, compliance support, and investigative solutions for banks, fintech companies, and corporate organizations.

supported

Our Core Services

Expert solutions designed to strengthen compliance and intelligence operations.

At Asia FIU, we provide a wide range of compliance, monitoring, and investigative services tailored to help organizations stay ahead of financial risks. Our team supports institutions by improving regulatory alignment, enhancing due diligence processes, and delivering precise intelligence that drives informed decision-making. Whether you’re preventing fraud, assessing risks, or meeting strict industry standards, we offer the expertise and tools you need to operate with confidence.

Our Core Services

AML Compliance Support

We help organizations build strong Anti–Money Laundering frameworks, ensuring they meet local and international compliance requirements with confidence.

KYC & Enhanced Due Diligence

Our team conducts detailed customer verification and risk assessments to help you identify suspicious profiles and prevent fraudulent activities.

Fraud Detection & Reporting

We provide advanced monitoring, investigation, and reporting support to help institutions detect, analyze, and escalate fraudulent transactions effectively.

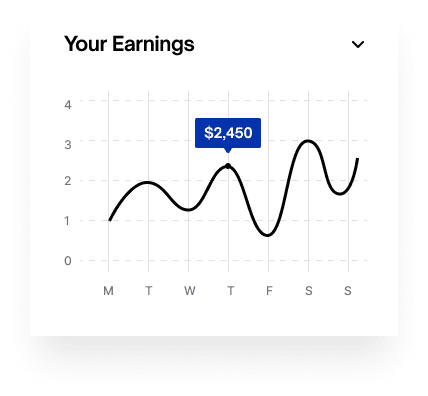

Transaction Monitoring Assistance

Asia FIU offers real-time and post-transaction monitoring services designed to flag anomalies, identify red flags, and improve operational oversight.

Risk Investigation & Analysis

Our experts conduct deep dives into high-risk cases, suspicious activity patterns, and financial inconsistencies to uncover potential threats.

Regulatory Advisory & Consulting

We guide institutions through complex compliance regulations, offering strategic advisory, staff training, and tailored frameworks that meet industry standards.

Testimonial

our happy Clients

Juliann Saucedo

Compliance Manager, Regional Bank

Cristal Travis

Director of Risk & Audit, Financial Institution

Ravi Malhotra

CEO, Fintech Startup

Agustina Hawthorne

Head of Compliance, Microfinance Organization

Strengthen your

institution with intelligence

you can trust.

frequently asked questions

We’re here for you, anytime.

Our intelligence support team is available to provide clarity, guidance, and rapid assistance whenever you need it. From investigations to compliance inquiries, we’re ready to help.

We support banks, fintech startups, microfinance institutions, investment firms, and regulatory bodies seeking stronger fraud prevention and compliance structures.

We assist with fraud detection, internal activity audits, suspicious transaction reviews, due diligence checks, and intelligence reporting for financial risk cases.

Yes. Our team provides continuous monitoring, advisory updates, and strategic guidance to help institutions remain aligned with global regulations.

Report timelines depend on case complexity, but rapid assessments are available for urgent investigations.

No. Our team handles the technical work—your organization simply provides the required information, and we take care of the rest.